Mastering Strategies for Trading on Pocket Option

Ditulis pada 26 Oct 2025 oleh AturToko

Mastering Strategies for Trading on Pocket Option

In the dynamic world of online trading, the choice of platform can significantly affect a trader’s success. One of the popular platforms that traders often turn to is Pocket Option. Known for its user-friendly interface and diverse trading options, Pocket Option offers a plethora of strategies that can help optimize trading outcomes. In this guide, we will explore various strategies, tips, and techniques to enhance your trading experience on Pocket Option. For a more comprehensive look at different strategies, you can visit Strategy Pocket Option https://pocket-option-uz.ru/strategii/.

Understanding Pocket Option

Pocket Option is a binary options trading platform that allows users to trade various assets such as currencies, stocks, commodities, and cryptocurrencies. The platform is designed for both novices and experienced traders, offering features like demo accounts to practice trading without real financial risk. Its appeal lies in the simplicity of the trading process and the potential for high returns.

Key Features of Pocket Option

Before diving into strategies, it’s crucial to understand some of the key features that Pocket Option provides:

- User-Friendly Interface: The intuitive design makes it accessible for traders at all levels.

- Low Minimum Deposit: Traders can start with a minimal investment, which is perfect for beginners.

- Diverse Asset Range: The platform supports various assets, offering numerous opportunities for trading.

- High Payouts: Traders can enjoy significant potential returns on investments, sometimes exceeding 90%.

- Social Trading: A unique feature allowing users to follow and copy successful traders’ strategies.

Essential Strategies for Pocket Option

To be successful in trading on Pocket Option, having robust strategies in place is vital. Here are some strategies you can employ:

1. Trend Following Strategy

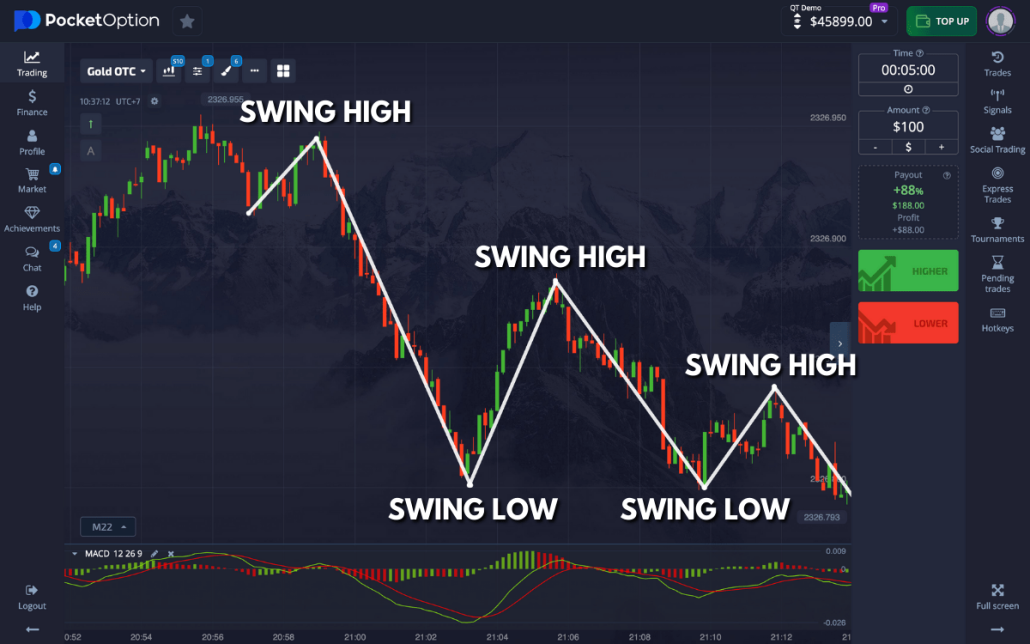

One of the simplest strategies involves following market trends. This method relies on the principle that “the trend is your friend.” Start by analyzing the charts and identifying whether the asset is trending upward or downward. Enter trades that align with the prevailing trend. For instance, if the asset price is consistently increasing, consider placing a call option. Conversely, if the trend is downward, a put option could be more appropriate.

2. Reversal Strategy

This strategy is based on the idea that the price movements will often reverse after reaching certain levels. Identify key support and resistance levels on the charts—where prices have previously struggled to break through. When the price approaches these levels, watch for signs of reversal such as candlestick patterns. Placing trades based on these reversals can lead to profitable outcomes.

3. CCI (Commodity Channel Index) Strategy

The CCI indicator is beneficial for identifying overbought or oversold conditions. A CCI reading above +100 suggests that an asset is overbought, while readings below -100 indicate oversold conditions. Traders can use these signals to strategically enter and exit trades. For example, when the CCI exceeds +100, it may be a good time to consider putting a put option, anticipating a price drop.

4. Multi-Timeframe Analysis

Analyzing different timeframes can provide a deeper insight into price movements and potential trading opportunities. Start by assessing the higher timeframes (such as daily or hourly charts) for trend directions, then shift to lower timeframes (like 5-minute or 15-minute charts) for entry points. This approach can help traders make more informed decisions and potentially increase their success rates.

5. News Trading Strategy

Economic news releases often cause volatility in the markets. Traders who stay informed about upcoming economic events (like interest rate decisions or employment reports) can capitalize on market fluctuations. However, it’s essential to wait for the news to be released and analyze the market’s reaction before entering trades, as initial reactions might be misleading.

Risk Management in Pocket Option

Regardless of the strategies employed, effective risk management is essential in trading. Traders should never invest more than they can afford to lose. Here are some tips for risk management:

- Set a Budget: Determine a trading budget and stick to it.

- Use Stop-Loss Orders: Implement stop-loss orders to limit potential losses.

- Limit Leverage: Avoid excessive leverage, as it can amplify losses.

- Diversify Trades: Spread investments across different assets to minimize risk.

Conclusion

Trading on Pocket Option can be a rewarding endeavor when approached with the right strategies and a sound understanding of risk management. By employing the strategies discussed above and continuously educating yourself, you can improve your trading performance and maximize your potential profits. Remember, success in trading takes time and practice, so be patient and stay committed to your trading journey.

Recent Posts

- Fort Vip Pub online casino added bonus Brave: Use the online now

- Dear 21 Casino 50 no deposit free spins or Live Ports Play Slots For real Currency

- Finest Local casino Reviews: Leading Web based casinos inside the 2025

- Enchanted Yard Casino AF

- Lifeless otherwise Real time Slot Totally free Gamble Internet Jungle Jim Rtp slot casino Slots Zero Install

Categories

- ! Без рубрики (32)

- 1 (36)

- 10 Jili Slot 145 (1)

- 10 Jili Slot 604 (3)

- 11 (5)

- 12 Play Malaysia 942 (1)

- 12play Casino Malaysia 305 (1)

- 12play Casino Malaysia 966 (3)

- 12play Live 12 (1)

- 12play Singapore 824 (3)

- 12play Slot 102 (1)

- 12play Slot 808 (1)

- 188 Bet 123 (3)

- 188 Bet Cdgh 864 (3)

- 188 Bet Link 200 (3)

- 188 Bet Link 544 (3)

- 188 Pg Bet 172 (3)

- 188 Rio Bet 897 (1)

- 188bet 25 Reais 24 (3)

- 188bet 250 154 (3)

- 188bet 250 575 (1)

- 188bet 250 696 (1)

- 188bet 250 857 (1)

- 188bet 68183 13 (1)

- 188bet 68183 277 (3)

- 188bet 68183 691 (1)

- 188bet Alternatif 17 (1)

- 188bet Alternatif 56 (1)

- 188bet Apk 21 (1)

- 188bet App 25 (3)

- 188bet App 454 (3)

- 188bet App 842 (3)

- 188bet App 942 (1)

- 188bet Bonus 878 (1)

- 188bet Cho Dien Thoai 209 (1)

- 188bet Cho Dien Thoai 579 (1)

- 188bet Cho Dien Thoai 990 (2)

- 188bet Codes 707 (2)

- 188bet Dang Ky 705 (1)

- 188bet Dang Ky 742 (1)

- 188bet Dang Ky 843 (1)

- 188bet Dang Nhap 799 (1)

- 188bet Danhbai123 551 (1)

- 188bet Danhbai123 954 (3)

- 188bet Download 171 (1)

- 188bet E Confiavel 507 (3)

- 188bet Hiphop 798 (1)

- 188bet Hiphop 971 (2)

- 188bet Link 417 (1)

- 188bet Login Link Alternatif 767 (1)

- 188bet Nha Cai 455 (3)

- 188bet Nha Cai 600 (1)

- 188bet One 51 (1)

- 188bet Vao Bong 639 (1)

- 188bet Vui 324 (3)

- 188bet Vui 902 (1)

- 188bet มือถือ เข้าสู่ระบบ 492 (1)

- 188bet 먹튀 73 (2)

- 188bet 우회 712 (1)

- 1bet5 (1)

- 1k (2)

- 1w (2)

- 1Win AZ Casino (2)

- 1win Azərbaycan (1)

- 1win Brazil (2)

- 1win casino spanish (3)

- 1win fr (2)

- 1win India (1)

- 1WIN Official In Russia (10)

- 1win Turkiye (4)

- 1win uzbekistan (1)

- 1winRussia (1)

- 1xbet (2)

- 1xbet arabic (2)

- 1xbet casino BD (1)

- 1xbet india (1)

- 1xbet Korea (2)

- 1xbet KR (1)

- 1xbet malaysia (3)

- 1xbet Morocco (1)

- 1xbet pt (1)

- 1xbet russian1 (1)

- 1xbet-1 (1)

- 1xbet-malaysia.com (1)

- 1xbet1 (4)

- 1xbet2 (4)

- 1xbet3 (3)

- 1xbet3231025 (1)

- 1xbet4 (3)

- 1xbet5 (1)

- 1xbet6 (1)

- 1xbet7 (2)

- 1xBetBangladesh (1)

- 2 (17)

- 20 Bet 133 (1)

- 20 Bet 217 (3)

- 20 Bet 234 (1)

- 20 Bet 262 (1)

- 20 Bet 416 (2)

- 20 Bet 447 (1)

- 20 Bet 535 (1)

- 20 Bet 536 (3)

- 20 Bet 899 (1)

- 20 Bet 964 (1)

- 20 Bet App 205 (3)

- 20 Bet App 63 (3)

- 20 Bet App 670 (1)

- 20 Bet Bet 646 (3)

- 20 Bet Bonus Code 917 (3)

- 20 Bet Casino 103 (3)

- 20 Bet Casino 293 (3)

- 20 Bet Casino 356 (1)

- 20 Bet Casino 433 (3)

- 20 Bet Casino 535 (1)

- 20 Bet Casino 684 (1)

- 20 Bet Casino 804 (3)

- 20 Bet Casino 822 (1)

- 20 Bet Casino 861 (3)

- 20 Bet Casino 873 (3)

- 20 Bet Com 131 (1)

- 20 Bet Com 659 (3)

- 20 Bet Login 153 (3)

- 20 Bet Login 362 (1)

- 20 Bet Login 503 (1)

- 20 Bet Login 56 (1)

- 20 Bet Promo Code 491 (3)

- 20 Bet Promo Code 515 (3)

- 20 Bet Promo Code 596 (3)

- 20 Bet Slovenija 389 (2)

- 20 Bet Tv Login 73 (3)

- 20 Pm Bet 660 (1)

- 20bet 5 Reais Gratis 657 (1)

- 20bet 5 Reais Gratis 770 (3)

- 20bet Apk 344 (2)

- 20bet Apk 576 (3)

- 20bet Apk 761 (1)

- 20bet App 367 (1)

- 20bet App 479 (1)

- 20bet App 526 (1)

- 20bet App 529 (1)

- 20bet App 66 (3)

- 20bet App 853 (3)

- 20bet Belepes 935 (3)

- 20bet Bewertung 140 (1)

- 20bet Bono Sin Deposito 670 (1)

- 20bet Bono Sin Deposito 855 (2)

- 20bet Bonus 147 (1)

- 20bet Bonus 157 (3)

- 20bet Bonus 265 (1)

- 20bet Bonus Bez Depozytu 769 (3)

- 20bet Bonus Code 245 (1)

- 20bet Bonus Code 655 (3)

- 20bet Bonus Code 705 (3)

- 20bet Bonus Code 715 (1)

- 20bet Bonus Code 976 (1)

- 20bet Bonus Code Ohne Einzahlung 271 (3)

- 20bet Bonus Code Ohne Einzahlung 725 (1)

- 20bet Bonus Code Ohne Einzahlung 768 (3)

- 20bet Casino 246 (1)

- 20bet Casino 255 (1)

- 20bet Casino 279 (1)

- 20bet Casino 347 (1)

- 20bet Casino 36 (1)

- 20bet Casino 403 (1)

- 20bet Casino 590 (1)

- 20bet Casino 685 (1)

- 20bet Casino 804 (2)

- 20bet Casino 875 (1)

- 20bet Casino 917 (3)

- 20bet Casino 945 (2)

- 20bet Casino Login 283 (1)

- 20bet Casino No Deposit Bonus 184 (1)

- 20bet Casino No Deposit Bonus Code 214 (1)

- 20bet Casino No Deposit Bonus Code 641 (1)

- 20bet Casino Review 872 (1)

- 20bet Cassino 572 (3)

- 20bet Com 197 (3)

- 20bet E Confiavel 951 (1)

- 20bet Entrar 777 (1)

- 20bet Erfahrungen 182 (1)

- 20bet Erfahrungen 874 (2)

- 20bet Erfahrungen 88 (3)

- 20bet Espana 635 (1)

- 20bet Italia 435 (1)

- 20bet Italia 60 (3)

- 20bet Kod Promocyjny Bez Depozytu 796 (1)

- 20bet Login 282 (1)

- 20bet Login 388 (3)

- 20bet Login 501 (1)

- 20bet Login 520 (3)

- 20bet Login 58 (2)

- 20bet Login 671 (1)

- 20bet Login 699 (1)

- 20bet Logowanie 430 (3)

- 20bet Logowanie 639 (2)

- 20bet Logowanie 888 (3)

- 20bet Norge 132 (3)

- 20bet Online Casino 871 (1)

- 20bet Opinie 542 (2)

- 20bet Osterreich 173 (1)

- 20bet Peru 593 (2)

- 20bet Pl 345 (1)

- 20bet Play 313 (1)

- 20bet Play 443 (3)

- 20bet Play 757 (1)

- 20bet Promo Code 541 (3)

- 20bet Recensioni 32 (1)

- 20bet Review 655 (1)

- 20bet Twin 263 (3)

- 20bet Εισοδος 43 (2)

- 20bet Εισοδος 873 (3)

- 20bet Εισοδος 92 (1)

- 20bet Τηλεφωνο Επικοινωνιας 998 (3)

- 20bet 入金 274 (3)

- 20bet 入金 345 (2)

- 20bet 登録 247 (1)

- 20bet 登録 748 (1)

- 20bet 登録 856 (1)

- 20bet 登録方法 307 (1)

- 20bet 登録方法 719 (3)

- 20bet 登録方法 943 (1)

- 20bet 見るだけ 388 (1)

- 20bet 見るだけ 483 (1)

- 20bet 視聴方法 238 (3)

- 20bet 視聴方法 292 (3)

- 20bet 評判 576 (1)

- 20bet 評判 963 (1)

- 22 Hellspin E Wallet 312 (1)

- 22 Hellspin E Wallet 714 (3)

- 22 Hellspin E Wallet 889 (1)

- 22 Hellspin E Wallet 920 (1)

- 22bet (1)

- 22Bet BD (2)

- 22bet IT (2)

- 26 (3)

- 28 (3)

- 3 (29)

- 322 (3)

- 352 (1)

- 395 (1)

- 3dxchat (1)

- 4 (4)

- 403 (1)

- 410 (1)

- 488 (1)

- 5 (18)

- 5-7 (1)

- 50 Free Spins Ggbet 809 (1)

- 50 Free Spins No Deposit Ggbet 891 (3)

- 535 (3)

- 6 (3)

- 627 (1)

- 7 (1)

- 777 Slot 548 (3)

- 777 Slot 70 (1)

- 777 Slot 732 (1)

- 777 Slot Vip 208 (3)

- 777 Slot Vip 740 (3)

- 777 Tadhana Slot 678 (1)

- 777 Tadhana Slot 928 (1)

- 77777777 (2)

- 777slot Casino 101 (1)

- 777slot Casino 384 (1)

- 777slot Casino 906 (1)

- 777slot Casino 941 (1)

- 777slot Casino Login 541 (3)

- 777slot Casino Login 602 (3)

- 777slot Casino Login 788 (1)

- 777slot Login 294 (3)

- 777slot Login 536 (1)

- 777slot Login 709 (3)

- 777slot Login 933 (3)

- 777slot Ph 99 (3)

- 777slot Vip 310 (2)

- 777slot Vip 841 (1)

- 777slot Vip 984 (3)

- 777slot Vip Login 151 (1)

- 777slot Vip Login 996 (1)

- 798 (1)

- 888 Casino App 750 (1)

- 888 Casino Login 139 (3)

- 888 Casino Login 809 (1)

- 888 Online Casino 342 (3)

- 888casino 275 (1)

- 888casino 891 (3)

- 888casino Apk 259 (1)

- 888casino Apk 6 (1)

- 888starz bd (1)

- 888starz Bet 679 (1)

- 888starz Bonusy 257 (3)

- 888starz Bonusy 625 (1)

- 888starz Bonusy 819 (1)

- 888starz Casino 553 (1)

- 888starz Kasyno 995 (3)

- 888starz Website 591 (3)

- 891 (1)

- 8k8 Casino Slot 540 (3)

- 8k8 Slot 117 (1)

- 8k8 Slot 285 (1)

- 8k8 Slot 293 (1)

- 8k8 Slot Casino 154 (6)

- 8k8 Vip Slot 274 (3)

- 8k8 Vip Slot 997 (1)

- 8x Bet 273 (1)

- 8x Bet 803 (3)

- 8x Bet 846 (1)

- 8xbet 1598921127 3 (3)

- 8xbet Apk 68 (1)

- 8xbet App 2 (1)

- 8xbet App 240 (1)

- 8xbet App 321 (1)

- 8xbet App 442 (3)

- 8xbet App Tai 487 (1)

- 8xbet App Tai 632 (1)

- 8xbet App Tai 672 (3)

- 8xbet App Tai 732 (1)

- 8xbet App Tai 775 (1)

- 8xbet Casino 723 (3)

- 8xbet Casino 850 (2)

- 8xbet Com 648 (1)

- 8xbet Dang Nhap 248 (3)

- 8xbet Dang Nhap 497 (1)

- 8xbet Dang Nhap 532 (3)

- 8xbet Dang Nhap 67 (1)

- 8xbet Dang Nhap 703 (1)

- 8xbet Online 27 (1)

- 8xbet Online 302 (1)

- 8xbet Online 770 (1)

- 8xbet Online 831 (1)

- 8xbet Online 972 (3)

- 8xbet Tai 409 (1)

- 8xbet Tai 496 (1)

- 8xbet Tai 527 (1)

- 8xbet Vina 368 (3)

- a16z generative ai (10)

- adobe generative ai 1 (1)

- adobe generative ai 2 (1)

- adobe generative ai 3 (1)

- affdays (1)

- agriculturavedicamaharishi (1)

- ai chat bot python (1)

- ai in finance examples 7 (1)

- Ai News (7)

- ai-diplom (1)

- akkordeonfest.ch (1)

- aliexpres.com.ua – офіційний сайт Аліекспрес в Україні (1)

- Allyspin-casino.net (5)

- Allyspinkasyno.pl (1)

- Almarokna (1)

- androidmostbetbd (1)

- aprBH (1)

- aprBT (1)

- aprCH (1)

- aprMB (2)

- aprPB (3)

- aprRB (1)

- Asino.casino (1)

- Asino.club (1)

- Asinoonline.com (1)

- AturToko Update (49)

- aug_bh (11)

- aug_bt (7)

- aug_BY (1)

- aug_ch_1 (1)

- aug_ch_2 (1)

- aug_prod (5)

- aug_rb (6)

- aug_sb (4)

- aug_slot_1 (1)

- aug_slot_2 (1)

- aug_slot_3 (2)

- Australian casino (2)

- austria (2)

- aviator (3)

- aviator brazil (2)

- aviator casino DE (1)

- aviator casino fr (1)

- aviator IN (1)

- aviator ke (2)

- aviator mz (3)

- aviator ng (12)

- azer1xbet (1)

- Azr Casino (1)

- b1bet BR (1)

- Bahigo Schweiz (1)

- bahsegel (5)

- bahsegel 13004 (1)

- Bankobet (1)

- Basaribet (1)

- bating9 (1)

- Bay 888 Casino 116 (1)

- Bay 888 Casino 580 (1)

- Bay 888 Casino 965 (3)

- bbrbet colombia (3)

- bbrbet mx (1)

- bc-game-uae.com (1)

- bc5 (1)

- bcg4 (2)

- bcg5 (1)

- bcgame (1)

- bcgame1 (10)

- bcgame2 (12)

- bcgame3 (11)

- bcgame4 (7)

- bcgame5 (3)

- bcgame6 (3)

- bcgame7 (1)

- Bdm Bet Espana 216 (3)

- Bdm Bet Espana 606 (3)

- Bdm Bet Promo Code 252 (1)

- Bdmbet App 970 (3)

- Bdmbet Casino 461 (3)

- Bdmbet Promo Code 156 (1)

- bedpage (2)

- behar.hr 2 (1)

- bessemercitymiddleschool.com (1)

- bestappstrading (1)

- Bet 188 402 (1)

- Bet 188 549 (3)

- Bet 188 612 (3)

- Bet 188 668 (1)

- Bet 188 72 (3)

- Bet 188 Link 316 (3)

- Bet 188 Link 767 (1)

- Bet 20 116 (1)

- Bet 20 710 (1)

- Bet 20 914 (3)

- Bet 20 971 (1)

- Bet 20 972 (2)

- Bet 20 App 744 (3)

- Bet Riot 222 (1)

- Bet Riot 230 (1)

- Bet Riot 591 (1)

- Bet Riot 774 (1)

- Bet Riot Login 425 (1)

- Bet Safe Bet 279 (1)

- Bet Safe Casino 559 (1)

- bet-1 (1)

- bet-12 (1)

- bet-13 (1)

- bet1 (11)

- bet13 (2)

- bet2 (11)

- bet20 (1)

- Bet20 160 (3)

- Bet20 575 (3)

- Bet20 59 (1)

- Bet20 957 (1)

- bet3 (9)

- bet365downloadapp.com (1)

- bet4 (5)

- bet5 (2)

- bet6 (1)

- bet8 (2)

- betblastcasino.onlin (1)

- betcasino5 (1)

- betonredcasino.gr – GR (1)

- Betriot App 419 (2)

- Betriot App 449 (2)

- Betriot App 492 (1)

- Betriot App 517 (1)

- Betriot App 592 (3)

- Betriot Bonus 236 (1)

- Betriot Bonus 899 (3)

- Betriot Casino 493 (2)

- Betriot Casino Italy 346 (3)

- Betriot Casino Italy 390 (1)

- Betriot Casino Italy 571 (1)

- Betriot Casino Italy 658 (2)

- Betriot Casino Italy 810 (3)

- Betriot Casino Italy 865 (3)

- Betriot Casino Italy 932 (3)

- Betriot Casino Italy 964 (1)

- Betriot Casino Login 361 (3)

- Betriot Casino Login 825 (3)

- Betriot No Deposit 498 (1)

- Betriot Online 441 (1)

- Betriot Online 609 (1)

- Betriot Online 645 (3)

- Betriot Online 89 (1)

- Betriot Recensioni 547 (1)

- Betriot Recensioni 662 (1)

- Betriot Recensioni 710 (3)

- Betriot Recensioni 855 (1)

- Betsafe Bet 886 (3)

- Betsafe Casino Slots 222 (1)

- Betsafe Casino Slots 590 (1)

- Betsafe Free Spins 547 (3)

- Betsafe Jackpot 533 (1)

- Betsafe Kasino 94 (3)

- Betsafe Online 122 (2)

- Betsafe Online 499 (1)

- Betsafe Online Poker 323 (1)

- Betsafe Online Poker 677 (1)

- Betsafe Pl 168 (1)

- Betsafe Pl 694 (1)

- Betsafe Poker 782 (3)

- Betsafe Poker 957 (1)

- Betsafe Site 788 (1)

- Betsafe Slots 76 (3)

- BETT (1)

- betting2 (1)

- betting5 (1)

- bettt (1)

- betwinner (2)

- betwinner-brasil.net (2)

- betwinner1 (10)

- betwinner2 (8)

- betwinner3 (10)

- betwinner4 (3)

- betwinner5 (1)

- Bigclash-canada.com (1)

- bistro-one.ie Casino Friday (1)

- Bitcoin Fees Rn 59 (1)

- bitcoincasinos (1)

- bizzo casino (1)

- Bizzo Casino 550 (2)

- Bizzo Casino App 389 (3)

- Bizzo Casino Bonus 11 (3)

- Bizzo Casino Bonus 21 (3)

- Bizzo Casino Bonus 769 (2)

- Bizzo Casino Bonus 891 (1)

- Bizzo Casino Bonus 897 (2)

- Bizzo Casino Bonus Code 130 (3)

- Bizzo Casino Bonus Code 132 (2)

- Bizzo Casino Bonus Code 161 (3)

- Bizzo Casino Bonus Code 252 (1)

- Bizzo Casino Bonus Code 290 (1)

- Bizzo Casino Bonus Code 310 (1)

- Bizzo Casino Bonus Code 423 (1)

- Bizzo Casino Bonus Code 538 (1)

- Bizzo Casino Bonus Code 636 (1)

- Bizzo Casino Bonus Code 64 (3)

- Bizzo Casino Bonus Code 663 (1)

- Bizzo Casino Bonus Code 735 (3)

- Bizzo Casino Login 131 (1)

- Bizzo Casino Login 140 (2)

- Bizzo Casino Login 565 (1)

- Bizzo Casino Login 675 (2)

- Bizzo Casino Pl 110 (1)

- Bizzo Casino Pl 195 (1)

- Bizzo Casino Pl 214 (1)

- Bizzo Casino Pl 267 (1)

- Bizzo Casino Pl 321 (3)

- Bizzo Casino Pl 924 (3)

- Bizzo Casino Promo Code 131 (3)

- Bizzo Casino Promo Code 611 (1)

- Bizzo Casino Promo Code 733 (1)

- Bizzo Casino Promo Code 922 (1)

- Bizzo Casino Promo Code 993 (1)

- Bizzo Casino Schweiz (1)

- Bizzocasino 259 (3)

- bizzocasino-greece.net – GR (1)

- blog (275)

- blogg (1)

- Bmw Casino Site 964 (1)

- Bmw Slot Casino 739 (1)

- Bmw Vip Casino 130 (3)

- Bmw Vip Casino 140 (3)

- bonanzagame (1)

- Bono Gratogana 443 (1)

- bonus (1)

- Bonus 888 Starz 62 (2)

- Bonus 888starz 648 (1)

- book (1)

- book of ra (1)

- book of ra it (1)

- Bookkeeping (21)

- bou-sosh6.ru 4-8 (1)

- Brand (3)

- brautzauber-darmstadt.de (1)

- Buy Semaglutide (6)

- camposchicken.pe (1)

- Car Service 122 (1)

- casibom tr (1)

- casibom-tg (3)

- casino (146)

- Casino 20 Euros Gratis Sin Deposito Por Registrar 10 Bet 957 (1)

- Casino 888starz 357 (1)

- Casino 888starz 672 (1)

- casino en ligne fr (1)

- Casino Energy 43 (2)

- Casino Energy 623 (3)

- Casino Gg Bet 786 (1)

- Casino Lemon 369 (1)

- Casino Luxury 658 (1)

- Casino Nv 283 (1)

- casino onlina ca (3)

- casino online ar (6)

- casinò online it (2)

- Casino Safe Bet 981 (3)

- casino svensk licens (1)

- casino utan svensk licens (1)

- casino zonder crucks netherlands (1)

- casino-10 (1)

- casino-11 (2)

- casino-12 (1)

- casino-13 (1)

- casino-19 (2)

- casino-4 (1)

- casino-5 (1)

- casino-6 (1)

- casino-7 (1)

- casino-8 (1)

- casino-9 (1)

- casino-bethall.it – IT (1)

- casino-casiny (1)

- casino-glory india (3)

- casino-quickwin.gr – GR (1)

- casino-sevencasino.com (1)

- casino-sugarino.se (1)

- casino1 (40)

- casino10 (2)

- casino11 (2)

- casino12 (2)

- casino13 (1)

- casino14 (4)

- casino15 (2)

- casino16 (4)

- casino17 (4)

- casino18 (1)

- casino19 (2)

- casino2 (28)

- casino20 (1)

- casino21 (3)

- casino22 (4)

- casino23 (4)

- casino24 (1)

- casino25 (1)

- casino3 (23)

- casino4 (13)

- casino5 (10)

- casino6 (9)

- casino7 (5)

- casino8 (7)

- casino9 (3)

- casinobet1 (1)

- casinodragonslots.no – NO (1)

- casinohrvatska (1)

- casinom (1)

- casinonon1 (1)

- casinoways-games.com (1)

- casiny (1)

- casiny1 (1)

- casinycasino (1)

- casiroomcasino.com (1)

- cazino24 (1)

- CCCCCCC (1)

- cccituango.co 14000 (1)

- ceske casino (1)

- CH (1)

- chat bot names 4 (1)

- chatgpt generative ai 1 (2)

- christofilopoulou.gr (1)

- ciroblazevic.hr (1)

- Cities (5)

- cityoflondonmile1 (1)

- cityoflondonmile2 (1)

- cityoflondonmile3 (1)

- cityoflondonmile4 (1)

- ck4444 (1)

- Como Registrarse Gratogana 168 (3)

- Content (2)

- crazy time (7)

- Crypto2 (1)

- Cryptocurrency exchange (4)

- csdino (1)

- customer service in logistics management 7 (1)

- czbrandss (1)

- Dang Nhap 8xbet 123 (3)

- Dang Nhap 8xbet 251 (1)

- Dang Nhap 8xbet 352 (3)

- Darmowe Spiny Energycasino 908 (3)

- de-onlinecasinos (1)

- degredachile.com (1)

- Demo Slot Jili 164 (1)

- Demo Slot Jili 222 (3)

- Demo Slot Jili 960 (1)

- dicewise-casino.se (1)

- Digital Marketing (93)

- diplomas-marketas (1)

- diplomsvuz (1)

- Dollycasino.live (1)

- Doradobet (1)

- Doradobet app (1)

- dormitan.es (1)

- Dragonia-hungary.com (1)

- Dragonslotscasino.org (1)

- Dragonslotscasino.pl (1)

- draussen-magazin (1)

- Droptheboss.org (1)

- Ecomretix.com (2)

- edu-alania.ru 36 (1)

- edusdiploms (1)

- eeeeee (1)

- elagentecine.cl (5)

- Energy Casino 956 (1)

- Energycasino Bonus 454 (1)

- Energycasino Bonus Bez Depozytu 181 (1)

- Energycasino Bonus Bez Depozytu 442 (3)

- Energycasino Bonus Bez Depozytu 945 (1)

- Energycasino Free Spin 212 (1)

- Energycasino Kod Promocyjny 323 (1)

- Energycasino Kod Promocyjny 764 (3)

- Energycasino No Deposit Bonus 39 (1)

- Energycasino No Deposit Bonus 604 (1)

- Energycasino Opinie 68 (1)

- Energycasino Opinie 730 (3)

- Energycasino Opinie 980 (1)

- Energycasino Pl 461 (1)

- Energycasino Promo Code 686 (1)

- Energycasino Promo Code 711 (1)

- Energykasyno 173 (1)

- Energykasyno 56 (1)

- Energykasyno 884 (1)

- entzugsklinikn (1)

- esc-privaterooms.de (1)

- exbroke1 (1)

- exbroker1 (1)

- Exness1 (2)

- exness2 (3)

- Exness3 (4)

- extrade2 (1)

- extradition (1)

- fadoinabox.pt (1)

- farma3 (2)

- farma4 (1)

- farmacia (2)

- farmacia2 (1)

- Fb 777 955 (2)

- Fb 777 Casino Login 143 (1)

- Fb 777 Casino Login 598 (3)

- Fb 777 Casino Login 999 (3)

- Fb 777 Login 289 (2)

- Fb777 App 937 (3)

- Fb777 Casino 112 (2)

- Fb777 Casino 583 (3)

- Fb777 Live 377 (1)

- Fb777 Live 378 (3)

- Fb777 Live 507 (3)

- Fb777 Live 639 (1)

- Fb777 Login 679 (3)

- Fb777 Login 767 (1)

- Fb777 Login 845 (1)

- Fb777 Pro Login 125 (3)

- Fb777 Pro Login 191 (3)

- Fb777 Pro Login 319 (1)

- Fb777 Pro Login 601 (2)

- Fb777 Register Login 581 (1)

- Fb777 Slot Casino 996 (1)

- Fb777 Slots 666 (3)

- Fb777 Vip Login Registration 470 (1)

- Fb777 Win 177 (3)

- Fb777 Win 204 (3)

- Fb777 Win 658 (3)

- FinTech (5)

- firescatterscasino.co.uk (1)

- Forex Trading (12)

- Fortune Gems Online 373 (1)

- Fortune Gems Online 717 (3)

- Fortune Gems Slot 807 (1)

- Fortune Gems Slots 521 (1)

- Fortune Gems Win 80 (1)

- fortune tiger brazil (1)

- FR_interac-casino (1)

- Free Fortune Gems 969 (1)

- Free Spin Casino 144 (1)

- Free Spin Casino 178 (1)

- Free Spin Casino 482 (1)

- Free Spin Casino 683 (1)

- Galactic Wins Casino 268 (1)

- Galactic Wins Casino No Deposit Bonus 192 (3)

- Galactic Wins Casino Review 858 (3)

- Galactic Wins Free Spins 482 (1)

- Galactic Wins Free Spins 511 (3)

- Galactic Wins No Deposit Bonus Codes 430 (1)

- Gama Casino (1)

- Gambling (10)

- Game (1)

- Game News (1)

- generative ai application landscape 1 (2)

- getmostbetbd (1)

- Gg Bet Casino 294 (1)

- Gg Bet Login 848 (1)

- Ggbet Casino 815 (3)

- Ggbet Free Slots 962 (1)

- gizebet.net (1)

- glory-casinos tr (1)

- GO (1)

- goldfishcasino (3)

- goszdiplom (1)

- Gratogana Bono 943 (1)

- Gratogana Casino 152 (3)

- Gratogana Entrar 393 (1)

- Gratogana Juegos En Vivo 28 (1)

- Gratogana Opiniones 192 (1)

- grefrather-buchhandlung.de (1)

- Hell Spin 1 Deposit 958 (1)

- Hell Spin 126 (1)

- Hell Spin 22 200 (1)

- Hell Spin 22 665 (3)

- Hell Spin 286 (1)

- Hell Spin 415 (3)

- Hell Spin 439 (1)

- Hell Spin 719 (1)

- Hell Spin 747 (1)

- Hell Spin 867 (1)

- Hell Spin 892 (3)

- Hell Spin Bonus 484 (1)

- Hell Spin Bonus 520 (3)

- Hell Spin Bonus Code 191 (1)

- Hell Spin Bonus Code 870 (3)

- Hell Spin Casino 146 (1)

- Hell Spin Casino 275 (1)

- Hell Spin Casino 453 (3)

- Hell Spin Casino 524 (3)

- Hell Spin Casino 68 (3)

- Hell Spin Casino 71 (1)

- Hell Spin Casino 776 (1)

- Hell Spin Casino Login 744 (1)

- Hell Spin Casino No Deposit Bonus 200 (3)

- Hell Spin Casino No Deposit Bonus 283 (1)

- Hell Spin Casino No Deposit Bonus 424 (3)

- Hell Spin Casino No Deposit Bonus 46 (1)

- Hell Spin Casino No Deposit Bonus 478 (3)

- Hell Spin Casino No Deposit Bonus 985 (1)

- Hell Spin Casino No Deposit Bonus Codes 287 (1)

- Hell Spin Kasyno 320 (3)

- Hell Spin Kasyno 41 (3)

- Hell Spin Kasyno 770 (1)

- Hell Spin Login 390 (1)

- Hell Spin No Deposit Bonus 235 (2)

- Hell Spin No Deposit Bonus 400 (1)

- Hell Spin No Deposit Bonus 571 (3)

- Hell Spin No Deposit Bonus 804 (1)

- Hell Spin Opinie 240 (3)

- Hell Spin Opinie 31 (1)

- Hell Spin Opinie 329 (3)

- Hell Spin Opinie 617 (1)

- Hell Spin Opinie 623 (3)

- Hell Spin Opinie 652 (1)

- Hell Spin Opinie 96 (3)

- Hell Spin Promo Code 569 (3)

- Hell Spin Promo Code 740 (1)

- Hell Spin Promo Code 826 (1)

- Hell Spin Promo Code 895 (1)

- Hellspin App 43 (3)

- Hellspin App 934 (1)

- Hellspin Australia 198 (1)

- Hellspin Australia 260 (1)

- Hellspin Australia 317 (3)

- Hellspin Australia 425 (1)

- Hellspin Australia 726 (2)

- Hellspin Australia 74 (1)

- Hellspin Bonus Bez Depozytu 825 (3)

- Hellspin Bonus Code Australia 111 (1)

- Hellspin Bonus Code Australia 290 (3)

- Hellspin Bonus Code Australia 721 (1)

- Hellspin Bonus Code Australia 81 (1)

- Hellspin Bonus Code No Deposit 860 (1)

- Hellspin Casino 157 (2)

- Hellspin Casino 893 (1)

- Hellspin Casino 967 (1)

- Hellspin Casino App 739 (1)

- Hellspin Casino App 801 (1)

- Hellspin Casino App 91 (1)

- Hellspin Casino Australia 18 (1)

- Hellspin Casino Australia 730 (1)

- Hellspin Casino Bewertung 840 (1)

- Hellspin Casino Bewertung 916 (3)

- Hellspin Casino Cz 395 (1)

- Hellspin Casino Login 117 (1)

- Hellspin Casino Login 154 (1)

- Hellspin Casino Login 393 (1)

- Hellspin Casino Login 433 (3)

- Hellspin Casino Login 549 (3)

- Hellspin Casino Login 605 (1)

- Hellspin Casino Login 691 (1)

- Hellspin Casino Login 786 (3)

- Hellspin Casino Login 792 (3)

- Hellspin Casino Login 915 (3)

- Hellspin Casino Login Australia 28 (1)

- Hellspin Casino Login Australia 54 (1)

- Hellspin Casino Login Australia 812 (1)

- Hellspin Casino No Deposit Bonus 225 (3)

- Hellspin Casino No Deposit Bonus 263 (1)

- Hellspin Casino No Deposit Bonus 635 (1)

- Hellspin Casino No Deposit Bonus 697 (3)

- Hellspin Casino No Deposit Bonus 710 (1)

- Hellspin Casino No Deposit Bonus 727 (1)

- Hellspin Casino No Deposit Bonus 988 (1)

- Hellspin Casino No Deposit Bonus Codes 989 (1)

- Hellspin Casino Review 350 (3)

- Hellspin Casino Review 372 (1)

- Hellspin Casino Review 573 (3)

- Hellspin Casino Review 68 (1)

- Hellspin Casino Review 872 (3)

- Hellspin Kasyno 465 (1)

- Hellspin Kasyno 478 (1)

- Hellspin Kasyno 628 (3)

- Hellspin Kasyno 761 (3)

- Hellspin Kifizetes 841 (1)

- Hellspin Kifizetes 886 (3)

- Hellspin Kod Bonusowy 159 (3)

- Hellspin Kod Bonusowy 179 (1)

- Hellspin Kod Bonusowy Bez Depozytu 275 (1)

- Hellspin Kod Bonusowy Bez Depozytu 572 (1)

- Hellspin Kod Bonusowy Bez Depozytu 799 (3)

- Hellspin Kod Promocyjny 48 (1)

- Hellspin Login 306 (1)

- Hellspin Login 502 (1)

- Hellspin Login 575 (1)

- Hellspin Login 583 (3)

- Hellspin Login 931 (3)

- Hellspin Login 998 (3)

- Hellspin Logowanie 492 (3)

- Hellspin Logowanie 577 (3)

- Hellspin No Deposit Bonus Codes 2024 545 (1)

- Hellspin No Deposit Bonus Codes 2024 691 (1)

- Hellspin Norge 167 (1)

- Hellspin Norge 169 (1)

- Hellspin Norge 421 (3)

- Hellspin Norge 492 (1)

- Hellspin Opinie 52 (1)

- Hellspin Pl 730 (1)

- Hellspin Promo Code 132 (3)

- Hellspin Promo Code 303 (1)

- Hellspin Promo Code 439 (1)

- Hellspin Promo Code 522 (3)

- Hellspin Promo Code 65 (1)

- Hellspin Review 715 (3)

- Hellspin Review 923 (3)

- Help Slot Win Jili 152 (3)

- Help Slot Win Jili 410 (3)

- Help Slot Win Jili 62 (4)

- Help Slot Win Jili 792 (3)

- Help Slot Win Jili 843 (1)

- hjbarreras (1)

- honey money (1)

- Hot News (1)

- hotlinecasino (3)

- Hotslotscasino.org (1)

- how does generative ai work (1)

- How Much Does Gas Cost 80 (1)

- httpsbass-bet.eu.complbonus – PL (1)

- httpsenergycasino.eu.comhulogin – HU (1)

- httpsposido-casino.eu.comes – ES (1)

- hundesalon-gerlindeade.de (1)

- icecasino-greece.com – GR (1)

- Icecasino-portugal.com (1)

- icestupa11 (1)

- icestupa12 (1)

- icestupa4 (1)

- icestupa9 (1)

- IGAMING (17)

- in-mostbet-casino.com (1)

- inasound.ru (2)

- indon-1xbe1.com (2)

- Indonesia Casino1 (5)

- Indonsia Slot Gacor (2)

- Indonsia Slot Gacor2 (1)

- Info Marketplace (49)

- Introduction to Digital (44)

- IPL (3)

- IronWallet App 158 (2)

- Is Galactic Wins Legit 756 (1)

- IT Education (1)

- IT Образование (3)

- Italian casino (1)

- ivermectina (1)

- Ivermectine (1)

- ivibet-casino.gr – GR (1)

- jaya9 (2)

- jaya91 (2)

- Jeetcity casino schweiz (2)

- Jili 777 Lucky Slot 947 (3)

- Jili Slot 777 349 (1)

- Jili Slot 777 69 (3)

- Jili Slot 777 Login 300 (1)

- Jili Slot 777 Login Register Online 81 (1)

- Jili Slot 777 Login Register Philippines 364 (1)

- Jili Slot 777 Login Register Philippines 384 (1)

- Jili Slot 777 Login Register Philippines 95 (1)

- july_bt (5)

- july_btprod (2)

- july_by (1)

- july_ch (5)

- july_goo (1)

- july_mars (3)

- july_mb (4)

- july_pb (2)

- july_rb (1)

- july_sb (3)

- july_slots (1)

- juneBH (4)

- juneBT (1)

- juneCH (8)

- juneGof (4)

- juneIPL (4)

- juneMB (1)

- junePB (4)

- juneProd (1)

- juneRB (1)

- jusstjob (1)

- kainagata (1)

- KaravanBet Casino (3)

- Kasyno Hell Spin 525 (1)

- Kasyno Online PL (3)

- kaszino1 (1)

- Kewirausahaan (90)

- Business Opportunity (37)

- Communication (13)

- Funding (8)

- Investment (4)

- Leadership (7)

- key2sales.se (1)

- kindseed (1)

- king johnnie (1)

- kosi-restaurant.de1 (2)

- kr.1xbet (1)

- Kudos Casino Free Spins 824 (3)

- Lainnya (45,494)

- legjobbmagyarcasino.online (1)

- Lemon Casino 50 Free Spins 367 (1)

- Lemon Casino 98 (3)

- Lemon Casino Kod Na Darmowe Spiny 780 (1)

- Lemon Casino Kod Promocyjny 933 (3)

- Lemon Casino Kod Promocyjny Bez Depozytu 270 (3)

- Lemon Casino Kod Promocyjny Bez Depozytu 394 (3)

- Level Up Casino Australia Login 574 (1)

- Level Up Casino Login 741 (1)

- Level Up Casino Login Australia 894 (1)

- Level Up Casino Sign Up 8 (1)

- Levelup Casino 275 (1)

- Levelup Casino App 180 (3)

- Levelup Casino Australia 345 (3)

- Levelup Casino Australia 950 (1)

- Levelupcasino 244 (1)

- Levelupcasino 532 (3)

- Link 188bet 407 (3)

- Link 188bet Moi Nhat 462 (1)

- Link 188bet Moi Nhat 485 (1)

- Link 8xbet 426 (1)

- Link 8xbet 465 (1)

- Link Vao 188 Bet 390 (3)

- Link Vao 188bet 177 (1)

- Link Vao 188bet 183 (1)

- Link Vao 188bet 589 (1)

- Link Vao 188bet 723 (1)

- Link Vao 8xbet 176 (3)

- Link Vao 8xbet 356 (1)

- Link Vao 8xbet 427 (1)

- Link Vao 8xbet 485 (3)

- Link Vao 8xbet 555 (3)

- Link Vao 8xbet 738 (2)

- littlebrothereli.com2 (1)

- lovecasino-review.com (1)

- lovepang.ie Malina (1)

- Lucky Cola Login 72 (1)

- Lucky Cola Slot Login 773 (1)

- Lucky Cola Vip 641 (1)

- Lucky Cola Vip 958 (1)

- luckyjunglecasino.se (3)

- luckymaxgames.com (1)

- luckystarcasino (1)

- Luxury Casino 50 Free Spins 221 (3)

- Luxury Casino 50 Free Spins 566 (1)

- Luxury Casino Rewards 868 (3)

- Magiuscasino.co (1)

- Management (117)

- Accounting & Finance (13)

- HRD (4)

- Legal (11)

- Marketing (49)

- Strategy & Operations (58)

- Supply Chain & Distribution (10)

- Manajemen Bisnis (51)

- Maribet casino TR (2)

- marios-grosser-traum.de (1)

- marsJUNE (4)

- Martin Casino (3)

- Masalbet (1)

- Maxi reviewe (1)

- mayBH (1)

- mayBT (2)

- mayPB (4)

- mayRB (2)

- Mcw Bet Casino 803 (3)

- Mcw Online Casino Philippines 916 (1)

- metabet18 (1)

- Mines 20bet 963 (2)

- mini-review (5)

- Mini-reviews (22)

- Mobileporngames (1)

- mombrand (1)

- mono brand (4)

- mono slot (5)

- Monobrand (30)

- monobrend (3)

- monogame (2)

- monoslot (4)

- mosbet-1 (2)

- mostbet (3)

- mostbet hungary (1)

- mostbet italy (1)

- mostbet norway (1)

- Mostbet Russia (1)

- mostbet tr (9)

- mostbet-2 (1)

- mostbet-4 (1)

- mostbet-5 (1)

- mostbet-azerbaycan-giris (1)

- mostbet-sports.com (2)

- mostbet1 (2)

- mostbet2 (1)

- mostbet3 (1)

- mostbet4 (1)

- Mr Bet casino DE (2)

- mr jack bet brazil (3)

- mx-bbrbet-casino (1)

- new (2)

- news (484)

- Nha Cai 8xbet 114 (1)

- Nha Cai 8xbet 189 (3)

- Nha Cai 8xbet 556 (1)

- Nha Cai 8xbet 580 (3)

- nine-gr.com – GR (2)

- ninewin-casino.com (1)

- Nn777 Slot Jili 418 (3)

- nov4 (1)

- NRGbetcasino.co.uk – UK (1)

- nutaku (1)

- Nv Casino Code 651 (3)

- Nv Casino Login 48 (1)

- Nv Casino Login 652 (1)

- Nv Casino No Deposit Bonus 340 (3)

- Nv Casino No Deposit Bonus 646 (1)

- Nv Casino Online 628 (3)

- Nv Casino Online Login 658 (1)

- Nv Casino Opinie 273 (1)

- Nv Casino Opinie 401 (1)

- NV Casino Schweiz Bewertungen auf TrustPilot (1)

- Nv Kasyno 20 Euro 63 (3)

- Nv Kasyno 20€ 369 (1)

- Nv Kasyno 20€ 434 (1)

- Nv Kasyno 227 (1)

- Nv Kasyno 348 (1)

- Nv Kasyno 604 (1)

- Nv Kasyno 788 (1)

- Nv Kasyno Apk 176 (1)

- Nv Kasyno Logowanie 483 (1)

- Nv Kasyno Online 892 (3)

- Nv Kasyno Opinie 924 (1)

- Nv Kasyno Pl 782 (1)

- Nv Kasyno Register 389 (3)

- Nv Kasyno Review 288 (1)

- Nv Kasyno Review 491 (1)

- Nv Online Casino 217 (3)

- Nv Online Casino 56 (1)

- Nvcasino 853 (3)

- oct (2)

- oct_airrightheatingandcooling.com (2)

- oct_bh (1)

- oct_pb (4)

- oct1 (3)

- oct2 (12)

- oct3 (2)

- Offizielle Casinia-Website (1)

- Offizielle Website des Buchmachers Rabona in Deutschland – rabonaonline.de (1)

- Offizielle Website von 20Bet in der Schweiz (1)

- olympusslots (1)

- Omegle (15)

- Omegle cc (13)

- omegle.is (2)

- Online Casino (14)

- online casino au (3)

- Online Casino Betsafe 167 (3)

- onlinekazinopolsha (1)

- onlone casino ES (1)

- OOOOOO (1)

- oren-ldpr.ru 20 (1)

- originadiplom (2)

- ozwin au casino (1)

- paribahis (12)

- paribahis 16200 (3)

- Partycasino App 196 (1)

- Partycasino App 374 (1)

- pauzazapregled.mk (1)

- pelican casino PL (4)

- Phlwin App Link 214 (3)

- Phlwin App Link 343 (3)

- Phlwin App Link 516 (1)

- Phlwin App Link 702 (3)

- Phlwin App Link 814 (1)

- Phlwin App Login 640 (1)

- Phlwin App Login 697 (3)

- Phlwin Bonus 135 (3)

- Phlwin Bonus 217 (3)

- Phlwin Bonus 700 (1)

- Phlwin Bonus 93 (3)

- Phlwin Casino 244 (1)

- Phlwin Free 100 194 (1)

- Phlwin Free 100 541 (1)

- Phlwin Free 100 781 (1)

- Phlwin Free 100 No Deposit 638 (1)

- Phlwin Free 100 No Deposit 639 (1)

- Phlwin Free 100 No Deposit 674 (1)

- Phlwin Free 100 No Deposit Bonus 196 (1)

- Phlwin Free 200 3 (3)

- Phlwin Login 124 (1)

- Phlwin Mines Bomb 849 (1)

- Phlwin Online Casino 671 (1)

- Phlwin Online Casino Hash 422 (3)

- Phlwin Online Casino Hash 999 (2)

- Phlwin Ph 804 (1)

- Phlwin Ph 858 (1)

- Phlwin Register 294 (1)

- Photographer 533 (2)

- Pin UP (2)

- Pin Up Brazil (2)

- Pin UP Online Casino (1)

- Pin Up Peru (1)

- Pin-Up AZ (1)

- Pin-Up Online (1)

- Pin-Up UZ (1)

- pin-up-qeydiyyat (1)

- pinco (18)

- Pinco türkiye (5)

- PinUp (15)

- Pinup casino (6)

- PinUp Giriş (1)

- pistolocasinò.it – IT (1)

- pınco (12)

- planet9.hr 2 (2)

- Plangames-germany.com (1)

- Plangames.io (1)

- Plangamesigralnica.com (1)

- Play Croco Australia 314 (3)

- Play Croco Australia 734 (1)

- Play Croco Casino 934 (1)

- Play Croco Casino Australia 89 (1)

- Playcroco Casino 924 (1)

- playerbonus (2)

- Playfina.casino (1)

- playmostbetbd (1)

- plinko (3)

- plinko in (1)

- plinko UK (5)

- plinko_pl (2)

- Plus 777 Slot 728 (1)

- Plus 777 Slot 836 (1)

- pocket-option.site (1)

- pocket-option.support (1)

- pocket-option2 (1)

- pocket-option3 (1)

- pocket-option4 (1)

- pocket0pti0n.com (1)

- pocket1 (1)

- pocket2 (1)

- pocketopt1on.com (1)

- pocketoption (1)

- pocketoption-online.com (1)

- pocketoption-platform.com (3)

- pocketoption1 (1)

- pocketoption2 (1)

- pocketoption3 (2)

- pocketoption4 (2)

- pocketoption5 (1)

- pocketoption6 (1)

- pokerdom (3)

- poland (3)

- Post (933)

- PPPPPPP (1)

- primadvd (1)

- primexbt1 (3)

- primexbt2 (4)

- primexbt3 (4)

- primexbt4 (1)

- Qizilbilet (1)

- Queen 777 Casino 175 (1)

- Queen 777 Casino 253 (1)

- Queen 777 Casino Login Philippines 260 (3)

- Queen 777 Casino Login Philippines Sign Up 323 (3)

- Queen 777 Login 100 (3)

- Queen777 Casino Login 520 (3)

- Queen777 Register Login 229 (1)

- rabbitwin-casino.com (1)

- Ramenbet (1)

- Rating of licensed and safe casino sites in South Korea on the100bestfleets.com (1)

- ready_text (40)

- Relocation (1)

- Review (15)

- Reviewe (5)

- reviewer (24)

- ricky casino australia (1)

- rise-of-olympus-100.com.gr (1)

- Rockyspin-casino.com (1)

- Roulette Safe Bet 41 (2)

- RRRRRR (1)

- RRRRRRR (2)

- RRRRRRRR (2)

- Rt Bet 319 (2)

- Rt Bet 398 (1)

- Rt Bet 446 (3)

- Rt Bet 913 (3)

- Rt Bet Online 850 (2)

- Rtbet Casino 321 (3)

- Rtbet Casino It 607 (3)

- Rtbet Casino It 642 (1)

- Rtbet Casino Login 164 (3)

- Rtbet Casino Login 605 (1)

- Rtbet Casino Login 724 (1)

- Rtbet Login 760 (1)

- Rtbet Recensioni 477 (3)

- rubds54.ru 4-8 (1)

- SBOBET1 (1)

- se (1)

- Semaglutide (4)

- Semaglutide Online (20)

- sep (7)

- sep1 (14)

- sep2 (17)

- sep3 (17)

- sep4 (15)

- sep5 (1)

- showbet 4860 (1)

- simpcity (1)

- Slot (3)

- Slot 8k8 931 (3)

- Slot Jackpot Monitor Jili 450 (1)

- Slot Tadhana 126 (2)

- Slot Tadhana 624 (3)

- Slot Tadhana 677 (1)

- Slot Tadhana 929 (1)

- Slot Tadhana 935 (3)

- Slot Tadhana 944 (3)

- slotmonster-casino2.com (1)

- Slots (13)

- Slots` (2)

- Slotsgemcasino.pl (1)

- Slotsgemkasyno.com (1)

- slottica (2)

- Slottica 66 437 (1)

- Slottica App 180 (1)

- Slottica App 514 (1)

- Slottica Bet 482 (3)

- Slottica Bonus 675 (1)

- Slottica Casino 617 (1)

- Slottica Casino 695 (3)

- Slottica Casino 883 (3)

- Slottica Casino App 717 (3)

- Slottica Casino App 975 (1)

- Slottica Casino Login 486 (1)

- Slottica Casino Login 520 (1)

- Slottica Casino Opinie 998 (1)

- Slottica Cassino 5 (3)

- Slottica Cassino 608 (1)

- Slottica Download 220 (1)

- Slottica Download 553 (3)

- Slottica Jak Usunac Konto 633 (3)

- Slottica Jak Wyplacic Pieniadze 299 (3)

- Slottica Jak Wyplacic Pieniadze 692 (1)

- Slottica Jak Wyplacic Pieniadze 952 (3)

- Slottica Kasyno 989 (1)

- Slottica Kasyno Bonus Bez Depozytu 205 (1)

- Slottica Kasyno Opinie 598 (1)

- Slottica Login 808 (1)

- Slottica Login 819 (1)

- Slottica Login 886 (1)

- Slottica No Deposit Bonus 225 (3)

- Slottica No Deposit Bonus 639 (3)

- Slottica Opinie 533 (1)

- Slottica Opinie Forum 731 (3)

- smokacecasino.se (2)

- Sober living (8)

- soft2 (1)

- soft2bet (1)

- Software development (7)

- spasateli44.ru 4-8 (1)

- Spin Away Casino 34 (1)

- Spin Away Casino 483 (1)

- Spin Away Casino 556 (1)

- Spin Away Casino 772 (3)

- Spin Away Casino 823 (3)

- Spin Away Casino 981 (1)

- Spin Bizzo Casino 189 (3)

- Spin Bizzo Casino 389 (1)

- Spin Bizzo Casino 7 (1)

- Spin Bizzo Casino 78 (3)

- Spin Bizzo Casino 949 (3)

- Spin Bizzo Casino 985 (2)

- Spin Casino Bonus 127 (1)

- Spin Casino Bonus 871 (3)

- Spin Casino Canada 206 (2)

- Spin Casino Login 140 (3)

- Spin Casino Login 988 (1)

- Spin Casino No Deposit Bonus 493 (2)

- Spin Casino Online 505 (1)

- Spin Casino Online 825 (2)

- Spin Casino Online 959 (3)

- Spin Casino Online 984 (1)

- Spin Casino Ontario 201 (1)

- Spin Casino Ontario 53 (2)

- Spin Casino Ontario 778 (1)

- Spin Casino Ontario 842 (1)

- Spin Casino Ontario 912 (1)

- Spin Palace Casino 143 (2)

- Spin Palace Casino 168 (1)

- Spin Palace Casino 439 (3)

- Spin Palace Casino 690 (3)

- Spin Palace Casino 962 (3)

- Spin Samurai Australia 366 (3)

- Spin Samurai Casino 430 (3)

- Spin Samurai Casino 860 (1)

- Spin Samurai Casino Australia 11 (3)

- Spin Samurai Casino Australia 183 (1)

- Spin Samurai Casino Australia 815 (1)

- Spin Samurai Free Spins 636 (1)

- Spin Samurai Login 868 (1)

- Spin Samurai Login 988 (1)

- Spin Samurai Slots 589 (1)

- spin-time.casin (1)

- Spinline-greece.com (1)

- spinmachine (4)

- Spinsamurai 20 (1)

- Spinsamurai 310 (3)

- stake-log.in (1)

- Starz 888 Bet 470 (3)

- stomat2 (1)

- Stonevegas.bet (2)

- Stonevegas.casino (1)

- Story (2)

- sugar rush (1)

- sugarrushslots (2)

- sweet bonanza (5)

- sweet bonanza TR (4)

- swipey (1)

- Swipey AI (1)

- Tadhana Slot 777 294 (1)

- Tadhana Slot 777 87 (1)

- Tadhana Slot 777 Download 612 (3)

- Tadhana Slot 777 Download 655 (3)

- Tadhana Slot 777 Download 889 (1)

- Tadhana Slot 777 Login 102 (3)

- Tadhana Slot 777 Login 692 (1)

- Tadhana Slot 777 Login Download 288 (1)

- Tadhana Slot 777 Login Download 463 (1)

- Tadhana Slot 777 Login Download 610 (3)

- Tadhana Slot 777 Login Download 85 (1)

- Tadhana Slot 777 Login Download 952 (1)

- Tadhana Slot 777 Login Register 167 (1)

- Tadhana Slot 777 Login Register 346 (1)

- Tadhana Slot 777 Login Register 880 (3)

- Tadhana Slot 777 Login Register Philippines 358 (3)

- Tadhana Slot 777 Login Register Philippines 560 (1)

- Tadhana Slot 777 Real Money 613 (1)

- Tadhana Slot 777 Real Money 772 (3)

- Tadhana Slot 777 Real Money 964 (1)

- Tadhana Slot App 302 (3)

- Tadhana Slot App 943 (3)

- Tadhana Slot Download 891 (3)

- Tadhana Slot Pro 106 (1)

- Tadhana Slot Pro 112 (1)

- Tadhana Slot Pro 434 (1)

- Tadhana Slot Pro 51 (1)

- Tai 8xbet 262 (1)

- Tai 8xbet 378 (1)

- Tala888 Com Login 161 (1)

- Tala888 Free 100 74 (1)

- Tala888 Log In 908 (1)

- Tala888 Login 249 (1)

- Tala888 Online Games 48 (3)

- Tala888 Slot 140 (1)

- tarhelydomain.com (4)

- ancorallZ 1500 (4)

- Teknologi (54)

- test (2)

- TextStat (299)

- Tge Meaning Crypto 360 (1)

- the-omegle (3)

- theporndude (1)

- thereoncewasacurl.com (1)

- tikitaka-casino.pt (1)

- Tippy Casino (2)

- TOP rating of the best casino sites in South Korea (1)

- trader10 (1)

- trader3 (1)

- Trading (3)

- Trading1 (2)

- trading13 (1)

- trading14 (1)

- Trading3 (1)

- trading4 (2)

- trading5 (2)

- trading8 (1)

- traiding1 (1)

- trivelabet.se (1)

- TTTTTTT (2)

- ug05 (1)

- uncategirized (1)

- Uncategorized (113)

- Up X (3)

- Uptown Pokies Bonus Codes 335 (3)

- Uptown Pokies Bonus Codes 446 (3)

- Uptown Pokies Casino Login 324 (1)

- Uptown Pokies Login 325 (1)

- Uptown Pokies Login 530 (3)

- Uptown Pokies Review 212 (1)

- Uptown Pokies Review 224 (1)

- Uptownpokies 158 (3)

- Uptownpokies 542 (1)

- vavada1 (1)

- vavada11.store (2)

- ancorallZ 3000 (2)

- Vegas Vulkan 11 (3)

- Vegas Vulkan 184 (1)

- Vegas Vulkan 980 (1)

- vegastars2 (2)

- vegastars3 (1)

- verde casino hungary (1)

- verde casino poland (1)

- verde casino romania (2)

- viagra (1)

- vickymartinberrocal (1)

- Vip Slot 777 Login 176 (1)

- Vip Slot 777 Login 317 (1)

- Vip Slot 777 Login 433 (1)

- Vip Slot 777 Login 982 (1)

- Vip Slot 777 Login 991 (3)

- voicube.ch (1)

- Vovan Casino (1)

- VPN (4)

- Vulkan Vegas Bonus 159 (1)

- Vulkan Vegas Casino 951 (3)

- vulkan vegas germany (2)

- Vulkan Vegas Kasyno 755 (3)

- Vulkan Vegas Kasyno 919 (1)

- Vulkan Vegas Login 46 (1)

- vulkhan.xyz (1)

- ancorallZ 2000 (1)

- Wash Service 733 (2)

- Washing Car Service 415 (1)

- Washing Car Service 552 (2)

- Wettigo (1)

- Wheelonroad.net (1)

- wikini (2)

- Win Spark 869 (1)

- Winspark 5 Euro Gratis 237 (2)

- Winspark 50 Giri Gratis 305 (1)

- Winspark 50 Giri Gratis 591 (1)

- Winspark Bonus 206 (3)

- Winspark Bonus 731 (1)

- Winspark Casino 337 (3)

- Winspark Free Spins 137 (2)

- Winspark It 501 (3)

- Winspark It 733 (1)

- winwin (1)

- wolfgold (2)

- Wordpress (2)

- worldestate (1)

- wowbet (2)

- www.ceipnorai.catcasinos-con-bizum (1)

- www.londonchinesechurch.com x2 (1)

- www.nationallampsandcomponents.co.uken-gb (1)

- www.stiledo.pl_plakaty (1)

- www.tpscoutleague.com x3 (1)

- Wwwlucky Colacom 243 (1)

- Wwwlucky Colacom 910 (3)

- X8bet 790 (1)

- Xoilac 8xbet 220 (1)

- Yukon Gold Casino 150 Free Spins 198 (3)

- Yukon Gold Casino Membre 875 (3)

- YYYYYYY (1)

- Zet Casino Bonus 301 (1)

- Zet Casino Bonus 46 (3)

- Zet Casino Games 780 (1)

- Zet Casino Games 926 (1)

- Zet Casino Promo Code 585 (1)

- Zetcasino 545 (2)

- zhv-eifel.de (1)

- Zodiac Casino Connexion 307 (3)

- Zodiac Casino Login 461 (1)

- Zodiac Casino Login In 687 (3)

- Zodiac Casino Sign In 22 (3)

- zwicky-sued.ch (1)

- Комета Казино (1)

- новости (1)

- Новости Криптовалют (2)

- сателлиты (3)

- Таро Онлайн (3)

- Финтех (3)

- Форекс Брокеры (3)

- Форекс обучение (4)

- Швеция (2)

- 카지노사이트 순위 한국에서 가장 인기있는 온라인 도박 플랫폼 (1)